Policy on government and private sector charging for the DVS

National Document Verification Service

Version 3.2

Context

To determine whether a government entity will be treated as private sector the DVS will apply the COAG competitive neutrality policy:

Competitive Neutrality Policy and Principles1

The objective of competitive neutrality policy is the elimination of resource allocation distortions arising out of the public ownership of entities engaged in significant business activities: Government businesses should not enjoy any net competitive advantage simply as a result of their public sector ownership. These principles only apply to the business activities of publicly owned entities, not to the non-business, non-profit activities of these entities.

The aim of this policy is to ensure competitive neutrality is maintained when offering access to the DVS.

Deciding who pays

The cost of providing the DVS to government agencies is met by the nine Australian governments. Providing DVS to business is cost recovered from consumers of the service. This applies to government bodies that operate as businesses.

The onus is on government entities that operate a business to provide evidence to the DVS Manager that they are not subject to Competitive Neutrality measures and therefore should not be charged for DVS use.

Additional information

Additional information to assist with decision making on Competitive Neutrality can be found here. A list of contacts points in each jurisdiction is available on page 49.

The following documents can be accessed from the Department of Finance website:

- List of Activities determined as Business Operations under Financial Management Accountability Orders 1997 Order 6.2.1

- List of Financial Management and Accountability Act 1997 agencies

- List of Commonwealth Authorities and Companies Act 1997 bodies

- List of Government Business Enterprises

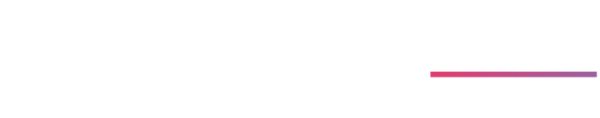

The following table details the decision-making process around whether a user entity is considered business or government for DVS purposes:

A flow chart detailing the decision-making process around whether a user entity is considered business or Government by the Document Verification Service.

Before a user can apply for DVS access, the entity’s commercial status must be established.

- Is the entity a private sector organisation (i.e. not Government owned)?

OR

- Is the entity a Government organisation, a Government Owned Corporation or a Government Business Enterprise?

Private Sector

The user is considered a commercial entity.

The entity is subject to the published transaction fees and will have access to commercially approved document types.

The entity will enter into a contract for its DVS access, this may be one of the following:

- Gateway service provider

- Identity service provider

- Business User

Government Business Enterprise

The user is considered a commercial entity.

The entity is subject to the published transaction fees and will have access to commercially approved document types.

The entity will enter into a contract for its DVS access, this may be one of the following:

- Gateway service provider

- Identity service provider

- Business User

Government Organisation or Government Owned Corporation

- Is the Government organisation or Government Owned Corporation subject to competitive neutrality obligations under the competitive neutrality policy relevant to its jurisdiction?

If the answer is yes: The user is considered a commercial entity.

The entity is subject to the published transaction fees and will have access to commercially approved document types.

The entity will enter into a contract for its DVS access, this may be one of the following:

- Gateway service provider

- Identity service provider

- Business User

The entity may choose to make competitive neutrality payments to the relevant jurisdictional body instead of being billed directly, however this will need to be discussed with its gateway service provider as the gateway service provider will be billed for its transactions.

If the answer is no: The user is considered a Government entity.

The entity is considered a government entity and will not be charged the published transaction fees. It will have access to all document types.

The entity will enter into a memorandum of understanding for its DVS access.

End of alternative text

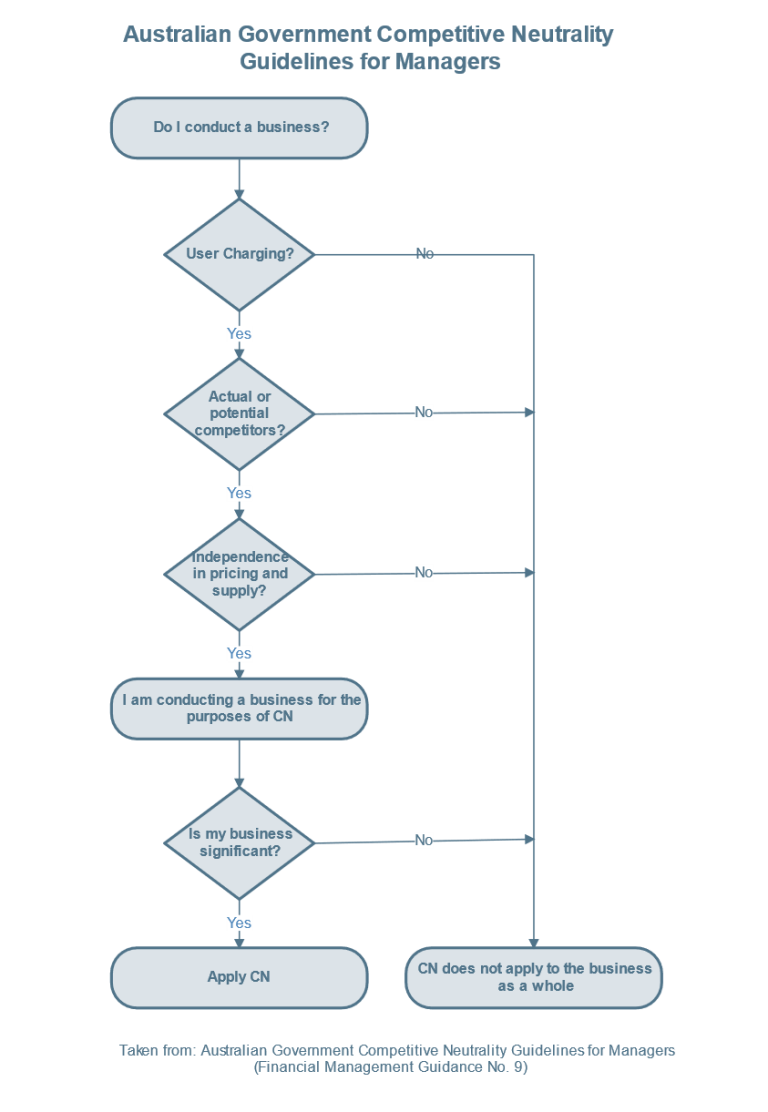

The following diagram is taken from the Australian Government Competitive Neutrality Guidelines for Managers (Financial Management Guidance No.9) and has been included to assist entities in understanding whether they are conducting a business:

The following diagram describes competitive neutrality guidelines to assist entities in understanding whether they are subject to competitive neutrality:

Australian Government Competitive Neutrality Guidelines for Managers

Do I conduct a business?

Does the activity involve user charging?

If No: Competitive neutrality does not apply to the business

If Yes: Does the business have actual or potential competitors?

If No: Competitive neutrality does not apply to the business

If Yes: Does the business have independence with pricing and supply

If No: Competitive neutrality does not apply to the business

If Yes: I am conducting a business for the purposes of competitive neutrality

Is my business significant?

If No: Competitive neutrality does not apply to the business

If yes: Competitive neutrality applies.

End.

This diagram was taken from: Australian Government Competitive Neutrality Guidelines for Managers (Financial Management Guidance No. 9)

End of alternative text

1 Competition Principles Agreement Tuesday, 11 April 1995 (As amended to 13 April 2007)

COAG - Competition Principles Agreement